Invoice Elements

In this article, you will see the elements that every invoice has and how you can use them.

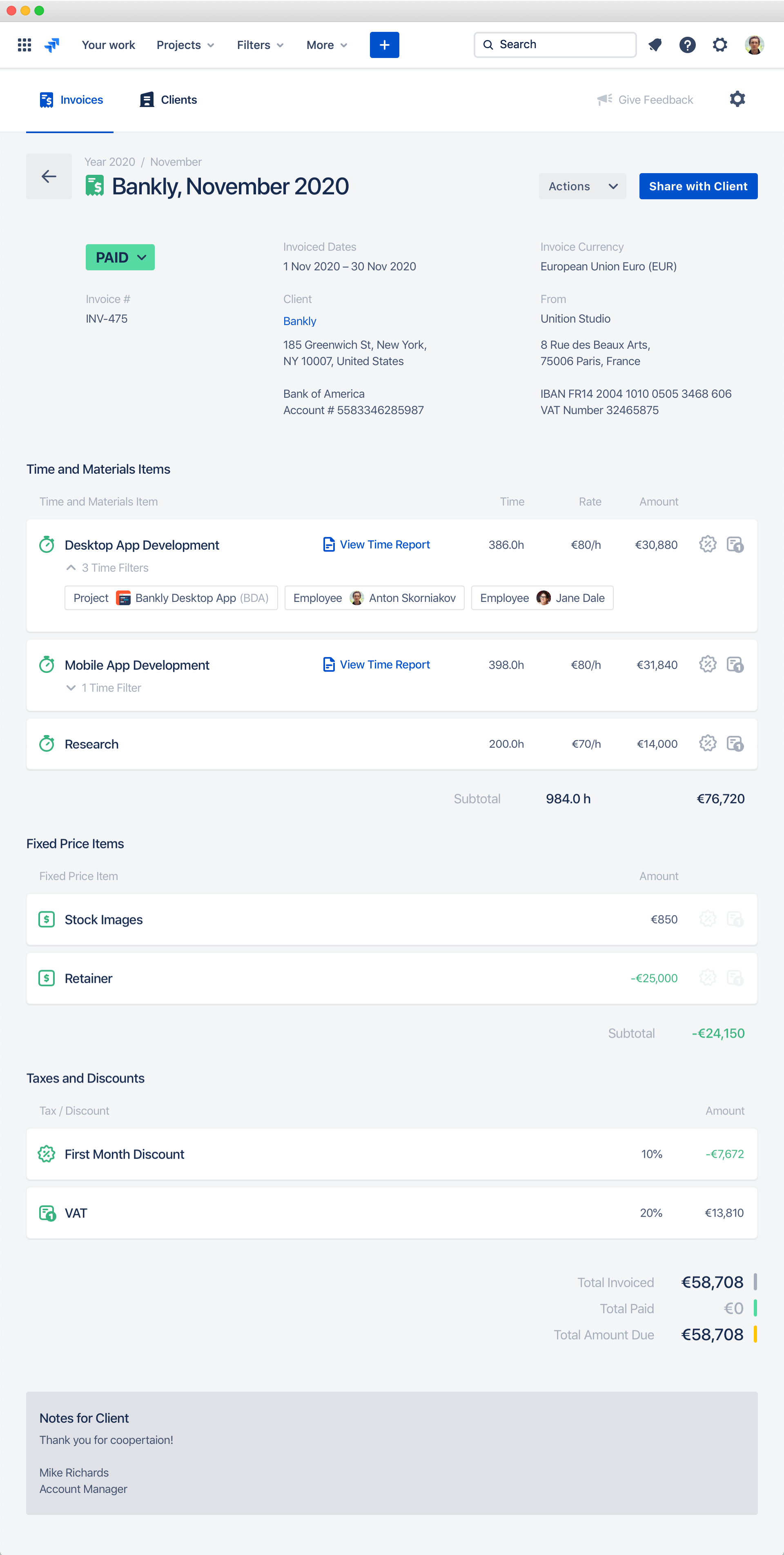

This is what a typical invoice looks like:

All elements are grouped into the following logical blocks:

- Basic invoice fields

- Linked budgets

- Time items

- Fixed price items

- Taxes and discounts

- Totals

- Notes for client

Let’s look at them one by one.

Basic Invoice Fields

These fields are pretty standard for any invoice:

| Field | Description |

| Subject | The subject line is the invoice title. It helps to identify the invoice. You can put an invoiced project or a service name here. For recurring invoices, you can consider putting month and year in the subject line. For example “Bankly Mobile App, November 2020”. |

| Status | The status of the invoice. You can read more about the statuses in the Invoice Statuses article. |

| Invoiced Dates | The dates that are being invoiced. This is mostly used for time and materials invoices. This field defines the dates range that will be used for importing team time from Jira. You can read more about using this field in the Time and Materials Pricing Model article. |

| Issue Date | The date when the invoice was issued. |

| Due Date | The date when the invoice should be paid. If the invoice has status Sent and its due date is in the past, the Due Date is highlighted by red. |

| Invoice Currency | The currency of all invoice amounts. See the Setting Invoice Currency article for more information. |

| Invoice Number | The unique invoice number. This number is used to identify the specific invoice. You can set a custom invoice numbers, and the Clerk will automatically increment them for every new invoice. Read the Custom Invoice Numbering article for more details. |

| Client | The name of the invoiced client. Read the Managing Clients article for more information about working with clients. |

| Invoice Layout | The invoice layout defines how this invoice will look for the client. Please read the Invoice Layouts article for more details. |

Linked Budgets

This block contains linked budgets from the Clerk Budgets app.

Time Items

The invoice items with time and materials pricing model. Every item contains a certain amount of work that is being invoiced to the client. Read the Time and Materials Pricing Model article for more details. You can easily mix different pricing models in one invoice. Read the Mixing Pricing Models in One Invoice article for more details.

Every time item has the following fields:

| Field | Description |

| Item Description | A description that explains what is invoiced in the current item. It could be work type, like “Back-End Development”. Or employees level, like “Senior Developers”. |

| View Time Report Link | The link to the time and cost report that shows time spent and cost per project, task and employee. The report is generated automatically if the time was imported from Jira. Read the Time and Cost Reports for Clients article for more details. If the invoice item time was entered manually, this link is not present. |

| Time Filters Applied | A list of time filters that were applied while importing time from Jira. Read the How Importing Time Works article for more details. |

| Time | The time spent by the team that is being invoiced. |

| Rate | The hourly rate that is applied to the current invoice item. |

| Amount | The invoiced item amount that equals Time × Rate. |

| Discount and Taxes Options | The discount and taxes options that show whether discount or specific tax is applied to the current invoice item. See the Applying Taxes and Discounts article for more details. |

Fixed Price Items

The invoice items with a fixed price model. Read the Fixed Price Model article for more details. Every fixed price item has the following fields:

| Field | Description |

| Item Description | A description that explains what is invoiced in the current item. |

| Amount | The invoiced item amount. You can enter a negative amount to take into account retainers and upfront payments that you have got from the client. Read the Retainers and Upfront Payments article for more details. |

| Discount and Taxes Options | The discount and taxes options that show whether discount or specific tax is applied to the current invoice item. See the Applying Taxes and Discounts article for more details. |

Taxes and Discounts

The taxes and discounts that are applied to the current invoice. Read the Applying Taxes and Discounts article for more details.

| Field | Description |

| Tax or Discount Name | The name of the tax or discount is being applied to the invoice. |

| Percentage | The tax or discount percentage that will be applied to the selected invoice items. |

| Amount | The total amount of the invoice discount or tax. |

Totals

| Field | Description |

| Total Invoiced | The grand total invoiced amount. |

| Total Paid | The total paid amount. Will be non zero if the invoice status is Paid by the client. |

| Total Amount Due | The total amount to be paid by the client. Will be positive if the invoice status is Sent to the client. It could be negative if the invoice items do not fully consume the retainer. |

Notes for Client

The notes that will be visible to the client. You can put here any comment or clarification for the client to add more transparency and clarity. The fewer questions client has the faster invoice will be paid!